"I think a lot of crazy stuff is gonna happen this year. Politics, markets, AI, all kinds of stuff. And I think it's important to focus on the long term. Focus on what you can control and not what's out of your control. Because it's very easy to spin yourself up and and get really upset. But do what you can. And stay safe."

Against all apparent odds, 2025 is almost history.

And once again, Alec was right.

Maybe it's because he hired me to join him in family-office risk management weeks before the 2008 Financial Crisis broke out.

Maybe it's because I saw Alec operate under fire, if you will, in the months and years that followed.

But I knew he was right back in early April.

The rest of the year just had to happen the way that it did, for the sake of underscoring it further.

You see, what I've come to learn from being in markets for a long time and by having people like Alec in my life is shockingly simple.

It would fit on a bar napkin, if that's all you had on hand.

There is never a better time or a worse time to do the right thing.

It's always the right time to do the right thing.

And conveniently, it's always the wrong time to do the wrong thing.

(As a mathematically minded person, I appreciate it when the converse statement is precisely valid.)

Now, to be clear, doing the right thing does not guarantee a "better outcome" in markets and elsewhere.

But it allows you to proceed with a confidence unavailable along "the alternative path."

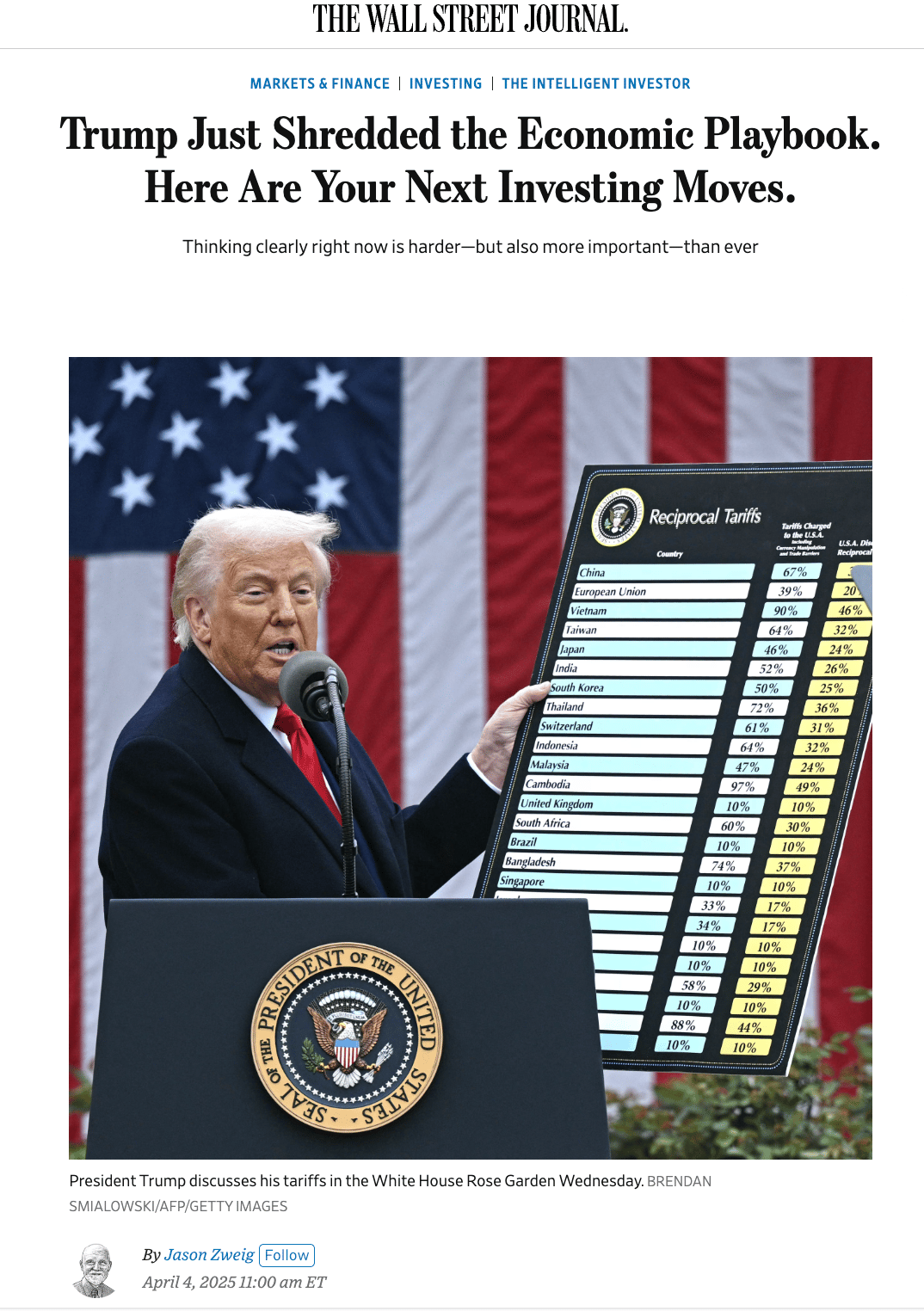

This is what I was thinking when I talked to Jason Zweig at The Wall Street Journal the day after the president walked into the Rose Garden with his reciprocal-tariff board and easel.

Jason asked a simple question in a couple of different ways:

"What do you think investors should do?"

As one of the most devoted advocates for the American investor, what Jason was asking really was "what is the right thing to do?"

At that moment, the right thing to do seemed to be whatever had the most credible probability of "doing no (further) harm."

As a student of market psychology, I understand that panic creates its own impetus to react. To do something. Anything. Flight or fight.

It also seemed painfully clear to me then that there were many wrong things to do.

Panic and sell everything. Gamble and lever up "bigly."

All things that could cause more harm than what the environment was offering as a baseline during that volatile week.

The job was to prioritize the "doing" into a pyramid, to exhaust the drive to react in a way that managed regret risk, first and foremost.

Because signing up for super-sized regret prospects under maximum uncertainty is no way to live and no way to invest.

This is what I wrote then in a piece titled “Good Grief:”

“Don't be surprised if the stock market is up or down 10–15% over the next month or so. I mean this NOT to be a sensationalist. I mean this to give you context...

So that you don't overreact to every 3% or 5% day along the way. Life must go on, even in this time of uncertainty.

And remember that greater uncertainty causes you to settle for less. Watch for that tendency in yourself and don't overindulge it.”

As we approach 2026, that still seems like the best path forward.

Life must go on, even in this time of uncertainty.

Do the right thing.

As it happens, it helped this year.

I suspect it will again next year, for better or worse.

That's the work ahead.

Disclaimer: All content here, including but not limited to charts and other media, is for educational purposes only and does not constitute financial advice. Treussard Capital Management LLC is a registered investment adviser. All investments involve risk and loss of principal is possible.

Full disclaimers: https://www.treussard.com/disclosures-and-disclaimers.