Over the last few days, this piece has been titled:

“This Is Why We Can't Have Nice Things”

“Now For The Hard Part”

“Can We Stick The Landing?”

And my favorite: “🤷♂️”

Fearing the last choice would be viewed as an accidental operator error, I've decided to go with "Good Grief."

It's been that kind of a week…

If you know what happens next, that makes precisely one of us.

In the real world, where the future is forever uncertain, one of your most important jobs as an investor is to bypass that part of your brain that insists it can predict exactly what’s going to happen next by projecting the recent past onto the immediate future.

We call that “nowcasting” and it can get you into a lot of trouble if you’re not careful.

I wrote about it here a few years ago.

When markets are hitting new highs, you can't imagine anything but higher prices still — which, of course, sets the stage for personal and collective excesses that are often rewarded with a black eye.

And when markets are in a free fall, your brain screams "Get me out of here!" You "know" it can only get worse… despite decades of market experience to the contrary.

Sure, "This Time Is Different" is always an option.

But remember:

→ Those are called the FOUR MOST DANGEROUS WORDS IN INVESTING for a reason.

This is why I often lean on the saying "Don't Just Do Something. Sit There."

Not that doing nothing is always the answer.

But anything that forces your lizard brain to take a beat, so you can think before you act, is worth repeating to yourself three times in a row in the shower.

Here is a framework that came out of a conversation with Jason Zweig last week, which might help.

“Imagine a simple pyramid, says Jonathan Treussard of Treussard Capital Management in Newport Beach, Calif. The pyramid has three layers, each representing a different likelihood of regret.

In the bottom layer are decisions you can take now that you are extremely unlikely to regret later.

The second layer consists of actions that you might later feel some regret over.

The third is made up of drastic decisions that are difficult if not impossible to reverse—making them prime candidates for intense regret down the road.”

From: Trump Just Shredded the Economic Playbook. Here Are Your Next Investing Moves, by Jason Zweig, The Wall Street Journal, April 4, 2025.

In case you’re a visual learner…

If you work your way up the pyramid, only moving to the next layer after having exhausted all available actions in the lower layers…

→ My guess is you'll be plenty exhausted from all that doing, and you may well run out of steam before you take on "high regret-risk" actions.

You’re not wrong.

This past week has felt “big.”

Do you Remember the Fall of the Berlin Wall?

It's the last major world event I only vaguely remember from my childhood.

Everything else since then feels crisp.

I remember watching on TV the attempted coup in Soviet Russia in the summer of 1991, wondering to myself, "What happens next?"

I remember the Gulf War and the Maastricht Referendum.

I remember nearly every detail of 9/11.

I remember the day Lehman Brothers went under as clearly as a tightly packed photo album.

I remember the night Barack Obama was elected and the night of Donald Trump’s election.

I remember listening live to the Brexit results.

I remember the heavy rain in California the day we were all told to stay home in March of 2020.

And I remember watching January 6, 2021 play out on live television.

April 2, 2025 now safely belongs to the list of days we will remember for a long time.

→ The comforting part is that we've been here before.

→ The disconcerting part is we don’t know what happens next.

Since then, approximately a million years have passed—from the day we imposed huge tariffs on everyone (April 9) to the day we suspended most (but not all) tariffs on everyone except China (get ready for this... also April 9. 🤷♂️).

I can tell you about every up and down in the stock market — probably not the most interesting, however cathartic it may be.

I can tell you about when markets moved from orderly to panicky, sometime over the weekend in the face of presidential silence and the rapid move up in Treasury yields between Monday and Wednesday of this week.

Turns out SAFETY is one thing, but LIQUIDITY is something else altogether.

I can tell you about Tuesday, when municipalities and local governments decided to pull bond offerings for fear that they would not find buyers.

I can tell you about Wednesday, which turned out to be the single best day for the stock market since October of 2008 — which is a little bit like claiming that last night was the best family dinner you've had since Mom and Dad announced they were splitting.

Somehow, there was always going to be more pain and heartache.

Is a Tsunami Next?

Two weeks ago, I said: "So far, this is a tremor, not an earthquake."

April 2 was the earthquake.

We are now on watch for whether a tsunami follows.

It helps to have a sense of magnitudes.

So you can brace yourself

(and go about your day in the meantime).

Given the recent reads in market volatility,

→ Don't be surprised if the stock market is up or down 10–15% over the next month or so.

I mean this NOT to be a sensationalist.

I mean this to give you context...

So that you don't overreact to every 3% or 5% day along the way.

Life must go on, even in this time of uncertainty.

And remember that greater uncertainty causes you to settle for less.

Watch for that tendency in yourself and don't overindulge it.

Here is one where context should help, even just for a minute.

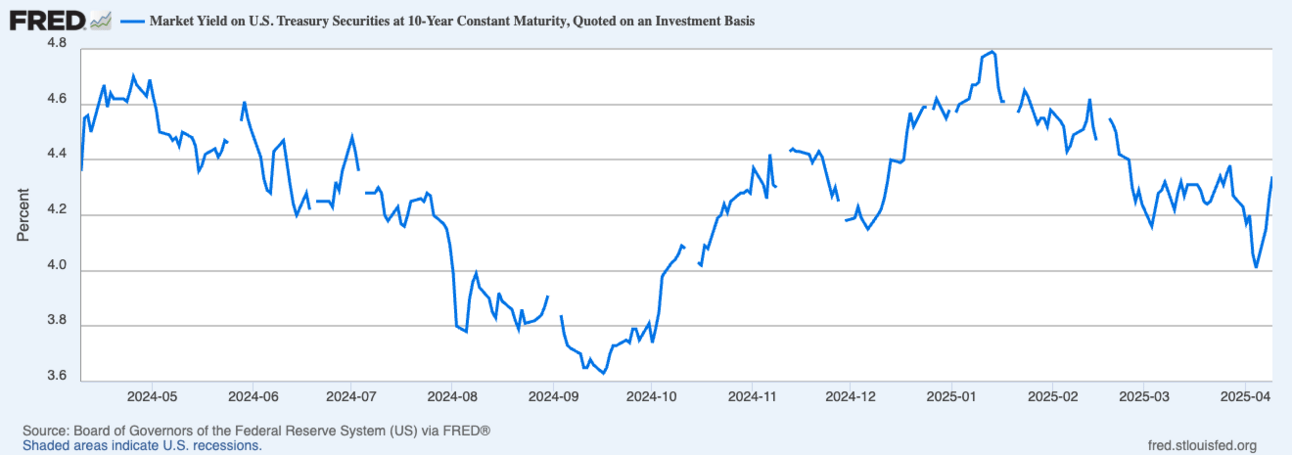

There has been a ton written this week about the massive selloff in U.S. Treasuries.

I don’t want to minimize it.

It’s been violent and highly unexpected (People usually flock to Treasuries in times of crisis).

Could it be more than hedge funds reducing their exposure to popular trades?

Absolutely.

Look at how much weaker the U.S. dollar has gotten and you could imagine a feedback loop of international investors reducing their Treasury holdings and repatriating assets to their domestic currencies. Some of this seems to be playing out in real time on Friday.

But here is the 10-year Treasury yield over the last year.

Not 3 years.

Not 5 years.

Not 10 years.

Just the last year.

Source: Federal Reserve Bank of St. Louis, through April 10, 2025.

Whatever is causing the rapid rise in Treasury yields has — so far — not caused it to move outside of the recent range.

Do we all wish Treasuries had bailed out our portfolios over the last week?

Sure.

Could we have inflicted so much damage on our national credibility that we will look back on April 2025 as the moment when the world decided that the U.S. Treasury bond was not the world's safest asset anymore?

I don't wish it. Not one bit.

And yet, it's entirely possible.

As always, time will tell.

But the Treasury market hasn't “broken.”

At least not yet…

Can We Stick the Landing?

Since the 90-day "pause" announcement on Wednesday, it's become painfully clear that the main attraction is now the open economic war between the U.S. and China.

Or, more to the point, between Trump and Xi.

Whether that was "the plan" all along—and whether the impetus was purely geopolitics, personal animosity, or both—or just the way the dominoes fell, here we are.

Monday morning quarterbacking is about as flawed as it gets.

And game theorists will be studying this week for years to come.

But Xi now looks to the world — and to his domestic audience — like he walked right into Trump's trap by retaliating first.

This gave Trump the short window he needed to lock Xi's China into a retaliatory tariff loop that poses a fundamental threat to China's economy.

If you're Xi and you like being in charge of the world's second-largest economy and military power, the calculus just got mighty complicated and you're now playing a higher-stakes game than ever.

This is why we should all hope that we can find a peaceful offramp.

And if someone needs to declare victory somehow, that they can stick the landing.

Because as much as we had problems two weeks ago — and boy, did we ever — instability between (and within) the world's two most powerful nations is the last thing everyone needs.

So I repeat, let’s hope we can stick the landing, somehow.

And if We Fail…

Last time, we talked about the rational theory of tariffs as a way to internalize a what economists can the “defense externality” caused by the import of valuable durable goods into a country.

If we wake up in 90 days with the tariff regime from three days ago in place…

We will be:

A nation with the most powerful military in the world.

A nation that’s spent decades building a world order built around international trade.

The far-and-away global leader in the provision of bleeding-edge knowledge and high-end services, from AI to financial services.

Aiming to stop the net import of all goods (durable and disposable alike) into our country.

Just because we’re incapable of dealing with two facts that perfectly hang together.

→ That we’ve “grown the pie” enormously over the last 30 years.

→ And that, among a number of unintended consequences, some of our people are getting slices that are painfully small relative to those of others.

Not dealing with facts so plain and evident for all to see is a recipe for disaster.

You don’t need to look far to see the direction of travel domestically.

Here is one.

“Billionaire Ken Griffin said President Donald Trump’s latest tariffs amount to a hefty tax on families and are a “huge policy mistake” by the administration.

It isn’t right to tell a middle-class or economically challenged family making $50,000 a year “it’s going to cost you 20%, 30%, 40% more for your groceries, for your toaster, for a new vacuum cleaner, for a new car,” Griffin said.”

To put it simply, blanket tariffs in the style of April 2 are a large-scale regressive sale tax levied on the consuming public in the United States of America.

The people who buy clothes and TVs at Walmart and Costco.

Historically, we’ve called those people “the working middle class.”

Good luck to them.

Good luck to us all.

In the meantime, whatever happens next, we’ll find out together.

Be well and don’t hesitate to reach out,

Jonathan

📌 Whenever you are ready:

Follow me on LinkedIn for more insights: Jonathan Treussard, Ph.D.

Subscribe to my newsletter at www.treussard.com/subscribe

Just reach out, including here

Disclaimer: All content here, including but not limited to charts and other media, is for educational purposes only and does not constitute financial advice. Treussard Capital Management LLC is a registered investment adviser. All investments involve risk and loss of principal is possible.

Full disclaimers: https://www.treussard.com/disclosures-and-disclaimers.