"Dylan got me through Vietnam."

That's what a very close friend of mine who served in Vietnam has told me a couple of times by now, whenever the topic of music or the topic of war has come up.

If you're worried about what happens next, I don't blame you.

The world is spinning at an unusual speed these days.

My guess is you'll find your own music to get through this violent mess we're finding ourselves in, but here is a short (and incomplete) list of music that's done the trick for me recently:

Our House by Crosby, Stills, Nash, and Young.

In the Summertime by Mungo Jerry (the music video is a trip of its own).

Literally any song by The Beatles with the word "LOVE" in the title.

And then there is the great philosopher Ozzy Osbourne. Listen to Crazy Train and tell me that's not what we need to hear.

Crazy, but that’s how it goes.

Millions of people living as foes.

Maybe it's not too late.

To learn how to love and forget how to hate.

I'm with Ozzy, however tall a mountain to climb it seems at the moment.

Starting Right Now, Fun Time is Over.

The math on short-dated U.S. Treasuries is shifting before our eyes.

We all knew that "T-Bill and Chill" (the idea that you could just invest in short-dated U.S. Treasuries and call it a day) couldn't last forever.

It now looks like the window is closing for good.

You see, the whole point of investing — if you ask any finance professor — is to move resources through time and space.

The holy grail for many is to do so without much risk — ideally, no risk at all.

Of course, as Mick Jagger wisely pointed out, you can't always get what you want. Which is what happens in markets, most of the time. That's how you end up with things like the first-order rule that "there is no free lunch" in investing. But for a while there, it felt like maybe there was.

Let's use round numbers for the sake of illustration.

Between May of 2023 and July of 2024, the interest earned on one-year U.S. Treasuries was roughly 5% or better. In equally round figures, inflation was running at 3% or so.

So… You could earn the interest on one-year Treasuries, pay your Federal taxes (as Treasuries are exempt from state and local taxes, which is nice if you're a resident of a high-tax state), and you could walk away with 3.15% or better, depending on your tax bracket.

For the mathematically inclined, 3.15% is indeed higher than 3%.

You could move resources through time and space, and grow wealth (even a little) net of taxes, net of inflation, and with arguably "little to no risk" (to the extent that the U.S. government has not made a habit of defaulting on its creditors).

In short, you could “T-Bill and Chill”…

I used to watch "That '70s Show" all the time. One of my favorite moments on the show was when Red Forman (the old-school stern dad) declared to his teenage son Eric:

Eric's response is comedic genius: "Where was I for fun time?"

I feel like Eric, to some extent; it's not like the recent past felt all that chill (remember April of this year?).

But… at least you could have a significant allocation to T-bills to take the edge off.

Recently, the math has been slowly getting less clear-cut.

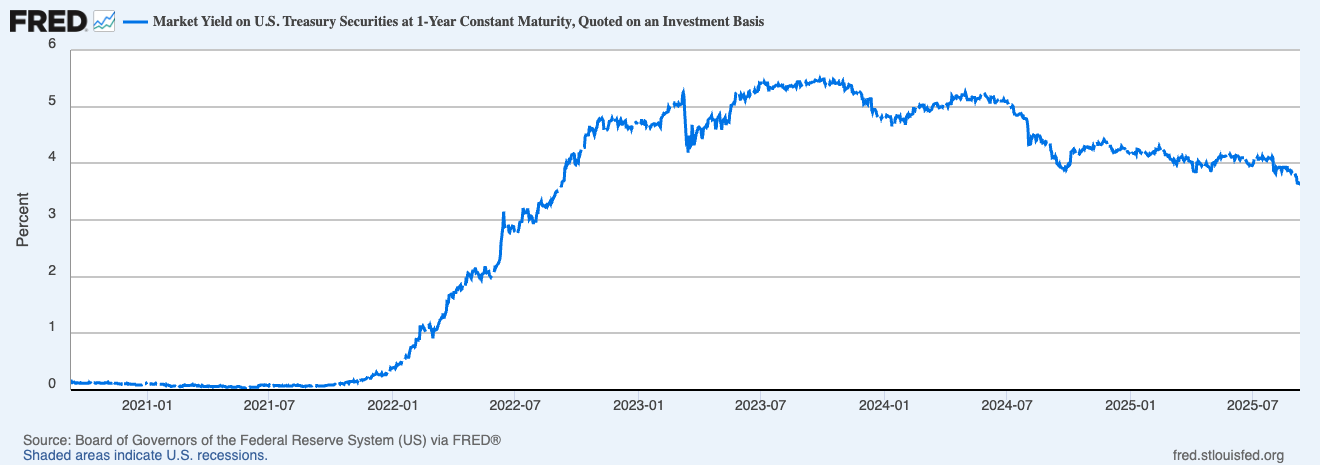

Look at this graph.

Source: Federal Reserve Bank of St Louis, 09/11/25.

The backend of 2024 and the beginning of this year got us down to 4%, which was getting tight from an after-tax and after-inflation standpoint. But as long as inflation was coming down, you could put up with it.

That’s been gradually changing recently.

The 1-year Treasury yield this week has been roughly 3.7%.

Pay your taxes and you’re down to 2.3% or so.

The most recent 12-month inflation was 2.7% roughly, according to the Bureau of Labor Statistics.

All of a sudden, it looks like one-year Treasuries are becoming a very slow-melting iceberg for your wealth.

Now, there still are plenty of good reasons to hold short-term Treasury bills, even if they’re not quite keeping up with inflation when it’s all said and done. But how much and for how long matters anew.

And if you’re thinking “now what?,” remember that knee-jerk reactions can come back to bite you just as much as not paying attention: Getting “smoked out” of the Treasury market may come with a solid dose of regret if you go up the risk scale in a big way and bad things happen, as they tend to once in a while.

So yeah, it looks like fun time is over…

You can’t ignore it.

Living in the real world is a requirement.

Ignoring change often doesn’t serve you well for very long.

(By the way, did you notice how quickly a roughly one-year blip in markets can start to feel like something you’re entitled to? We don’t like giving up comfort and nice things. But sometimes, we don’t get to choose.)

Now remember that financial markets are fundamentally a chess board.

Make sure your next move is strategic and in the service of your end goals.

Not anyone else’s.

I could tell you to reach out, but that feels cheap.

That said, that is what I do for the people I work with.

On the way out… I had a really fun conversation on TREUSSARD TALKS with my friend and "colleague" at University of California, Irvine, Michael Imerman (He's a real prof; I just taught one course in Behavioral Finance to the Master's of Finance students this summer, which was a whole lot of fun).

Michael recently published a book on The Economics of FinTech, which is a portmanteau for Financial Technology. Think blockchain, AI, and quantum computing applications to finance.

Michael is brilliant and the conversation is worth a listen.

You can check out my conversation with Michael here: https://www.treussard.com/newsletter/defining-fintech-with-michael-imerman

Be well, talk soon.

And as Ozzy said, “learn how to love and forget how to hate.”

Jonathan

Disclaimer: All content here, including but not limited to charts and other media, is for educational purposes only and does not constitute financial advice. Treussard Capital Management LLC is a registered investment adviser. All investments involve risk and loss of principal is possible.

Full disclaimers: https://www.treussard.com/disclosures-and-disclaimers.