Here is the type of thing that happens when you put time (and luck) on your side.

I started Treussard Capital Management almost two years ago.

No clients. No website. Nothing.

Just highly relevant experience...

Which started with a baptism by fire working in risk management for the Ziff family office in 2008.

Treussard Capital Management's client base in New York has grown over the last two years.

And now it's official...

Treussard Capital Management just registered with the State of New York!

We've had clients from coast to coast from the start.

But reaching critical mass in NY is very special to me.

→ You can read more about why here.

And I was Hanna Larsson's guest this week in her LinkedIn newsletter, which has over 120,000 subscribers (!) — I am grateful to Hanna for her friendship and for using her public platform to empower people, including in the middle of a very volatile stock market.

Go check it out and sign up for her newsletter, The Future of Work.

OK, it’s been a long month, so let's keep this one relatively short. 😉

Let’s put April 2025 in perspective.

As uncertainty grows and stress rises, your SURVIVAL INSTINCTS kick in.

Your survival instincts mean well…

They are literally intended to keep you safe from predators.

But the road to hell is paved with good intentions (and lots of unforced errors).

I recently had a fun conversation with Alec Crawford who was my boss when he was Head of Risk Management for the Ziff family during the 2008-2009 financial crisis.

Alec reminded me that humans do a lot of silly and self-defeating things when markets turn up the pressure.

Your mental horizon shrinks down to:

→ days,

→ then hours,

→ and eventually minutes.

People "just want to get through today in one piece."

That's a bad situation you can easily make worse.

That's when you make decisions you'll often regret later.

Here is a (mental and physical) health tip…

Walk away for a minute.

Go for a walk with your dog.

Of course, "walking away" isn't quite an option for me.

So you know what I do?

I look at data to keep my bearings through the storm…

So lucky you, here are some data. 🙂

Everyone has been talking about the stock market having some of the largest swings since the depths of the 2008 Financial Crisis — for some of the strangest reasons on record.

But the thing that's getting people worried is whether this is a "Sell America" moment.

They worry that American Exceptionalism is melting away in front of our eyes.

That's because the U.S. dollar has been falling at the same time that stocks have been selling off, and Treasury yields have risen in the middle of this mess.

This is inconsistent with people taking refuge in the greenback and buying up bonds, as part of a standard-playbook "safety trade."

There are lots of interpretations that make this "bad."

Top of the list is that people are bailing on America and shipping investment capacity to places like Europe and Japan. That’s possible, even probable.

Or maybe the market is sniffing a world where the U.S. economy stalls but inflation moves higher, making the dollar weaker and Treasury bonds less appealing.

All reasonable concerns… and nothing we should wish for, for everyone's sake.

But consider magnitudes.

And consider where markets were at the end of 2024.

Let’s start with U.S. Treasuries…

U.S. Treasury bonds are the most important assets in global financial markets.

Think of U.S. Treasuries as the Swiss Army knife of capital markets.

They’re key to everything functioning the way it does around us.

So when yields go up sharply and people worry that we're having (or could have) a run on Treasuries, you should worry too...

And yields did go up a good bit during the post-"Liberation Day" market meltdown.

But let's go back and look at all data since 2000 for U.S. Treasuries with maturities from 1 year to 30 years.

For each maturity, reading from left to right, the box covers the range from the 25th percentile (where 25% of all yields since 2000 are to the left of that point) to the 75th percentile (same idea but to the right), with the red vertical line marking the median, and the red dot showing the latest value.

Note data are through last week. Markets move fast these days. But the main point remains.

At a high level, all maturities are now at roughly the 75th percentile.

Elevated for sure, but not off the charts.

If shorter maturities start pushing up to 5%, that’ll be something.

Same with 6% for the longer-dated bonds.

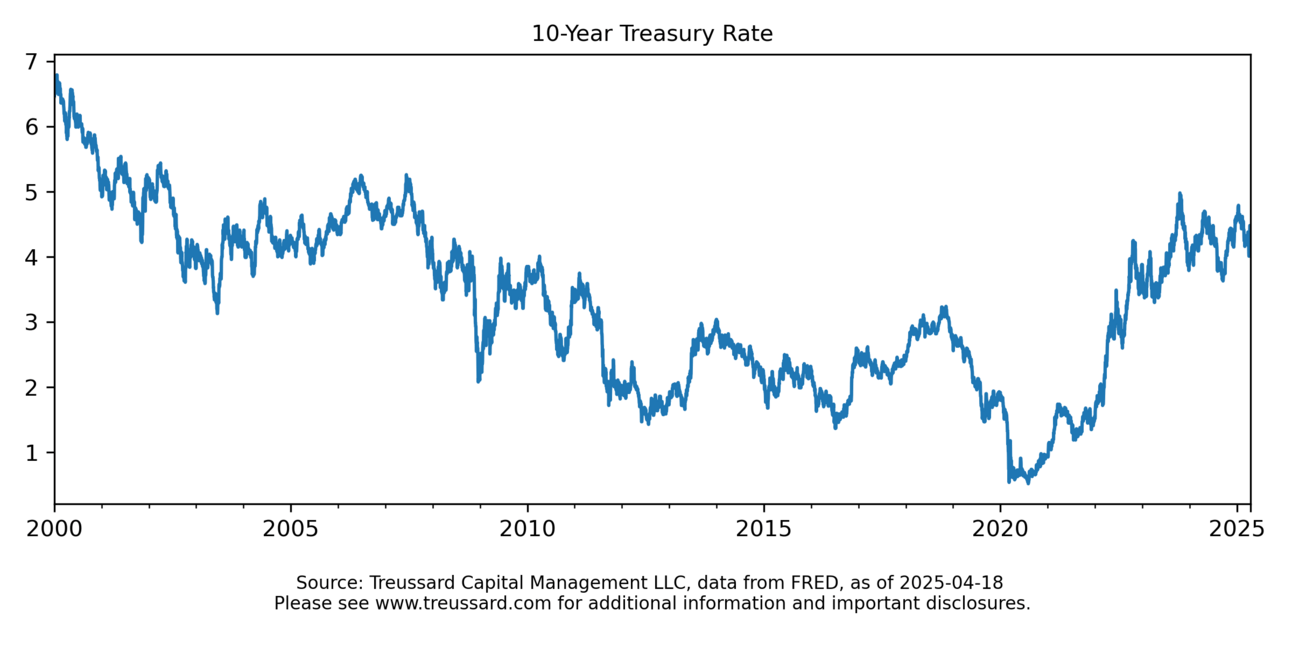

Another way to get to the same place is to actually look at the yield on the 10-year U.S. Treasury over time.

If U.S. Treasury bonds are the Swiss Army knife of markets, the 10-year Treasury bond is HAL 9000 — it is all-powerful and omniscient.

Does it look out of bounds to you?

We've basically been range-bound for the last couple of years, in a big-picture kind of way.

Sure, it feels too high for the people who benefited massively from borrowing "Other People's Money" at low rates in the post-Financial-Crisis era.

But America was plenty exceptional back in 2000 when the 10-year yield was 6% plus.

So is it possible that longer-term, we will see early 2025 as a turning point? Completely possible.

And is it possible that the low rates we all enjoyed during the 2010s won't be the norm going forward? Also possible, especially if we end up with structurally higher inflation.

But so far, it doesn't look like the U.S. Treasury market has broken the glass… Let's see what May (and June and July…) brings.

On to King Dollar.

The U.S. dollar has gotten much cheaper since April 2.

→ The Euro is roughly 5-6% stronger.

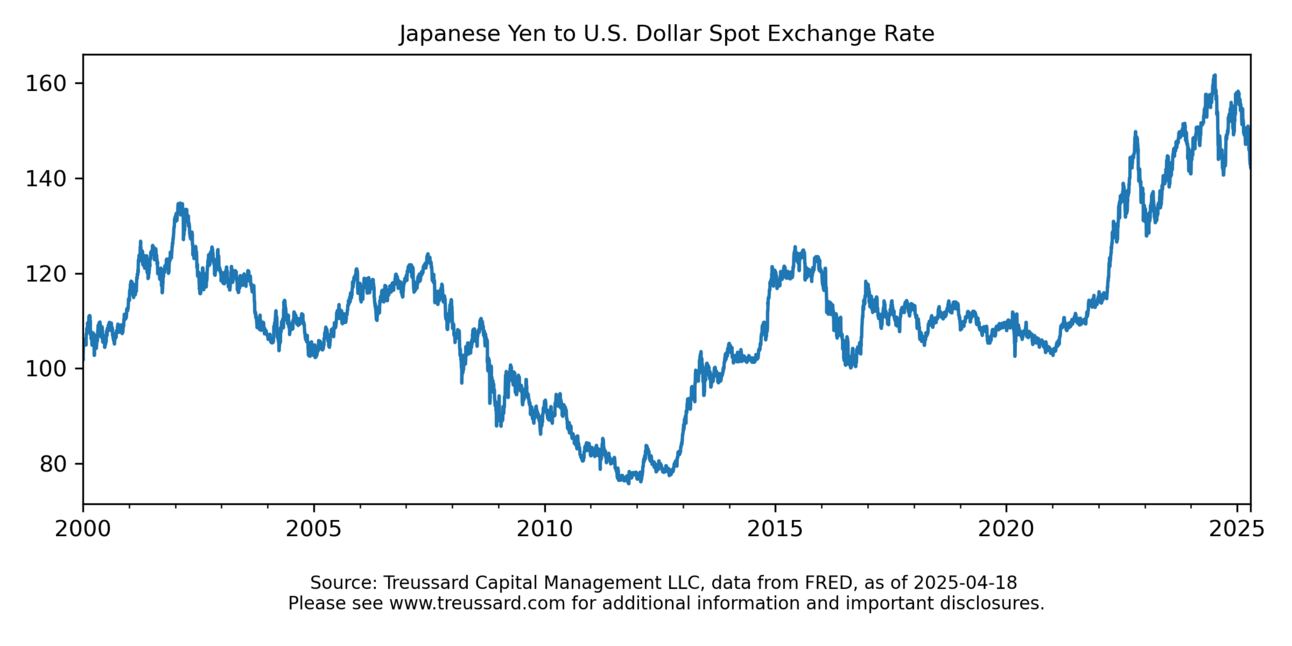

→ Same for the Japanese Yen.

But has the dollar sold off to the point of being "cheap?"

Check out these graphs… First the Euro in U.S. Dollars and then the Dollar in Yen.

Sure, if you're in the middle of planning a European vacation this summer, this is no fun.

The Euro at 1.15 dollars is no 1:1 deal like in 2022.

But realistically, 1.2 would not be unreasonable based on history alone, if the U.S. economy were to slow down.

Same goes for the Japanese Yen.

140 Yen per dollar is a serious drop from 160 last summer.

But did you really think that Japanese vacation would be some version of half-off forever?

The stronger dollar over the last few years has largely been the result of a piping-hot U.S. economy and higher return on capital in the U.S. coming out of the pandemic.

How much of this recent move is a "run away from all things America" and how much of this is the much more pedestrian recognition that the U.S. may be slowing down under the weight of policy uncertainty?

A slower U.S. economy — and its potential impact on relatively expensive U.S. stocks — is a perfectly good reason to repatriate a few buckaroos home at the margin, if you're a European investor or a Japanese investor.

As with all things that lie in the future, time will tell.

But this is pointing to a solution to the riddle we’re all facing…

The economy, where real people live.

Here is the real tough part.

The U.S. economy has been doing very well over the last few years.

Not evenly for everyone, but very well nonetheless.

And I’ve said before that assuming bad things must follow good things is called superstition.

Not a reliable mode of analysis.

But the economy is a huge set of reaction functions, where what one person does affects the actions of another, and before you know it, things are snowballing in one direction or another.

Given the actions at the top, if you will, people are anxious that widespread worrying alone might cause a slowdown…

And we've had it so good it might hurt on the way down.

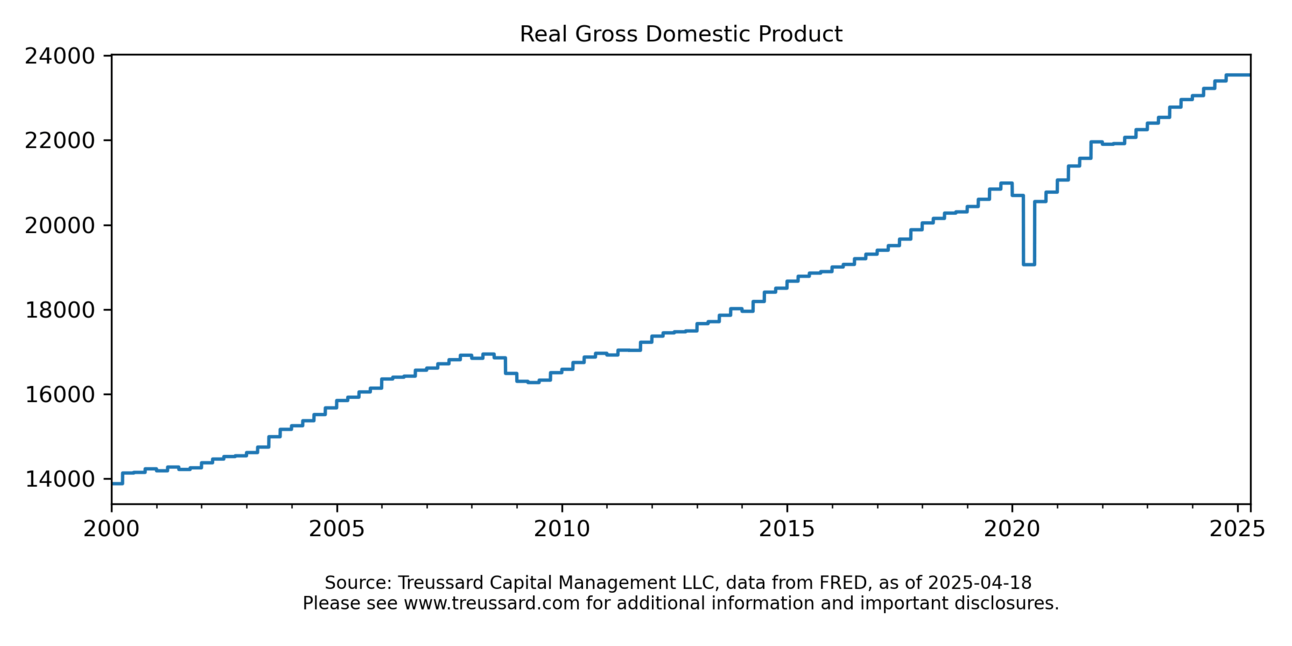

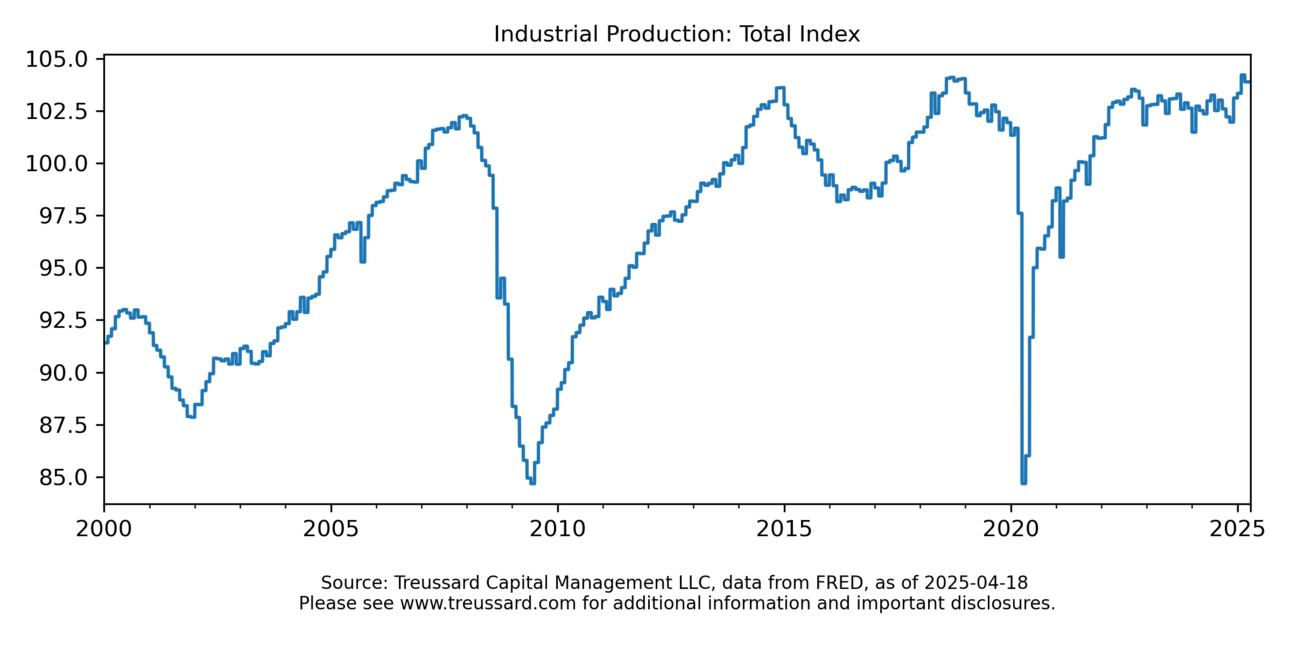

See the charts below.

GDP is at an all-time high. That tends to be the case, as we all work so hard at growing the economy all the time. But when it flatlines or dips, that feels really bad.

Industrial production, same thing. Right near the top of the range, going back to 2000.

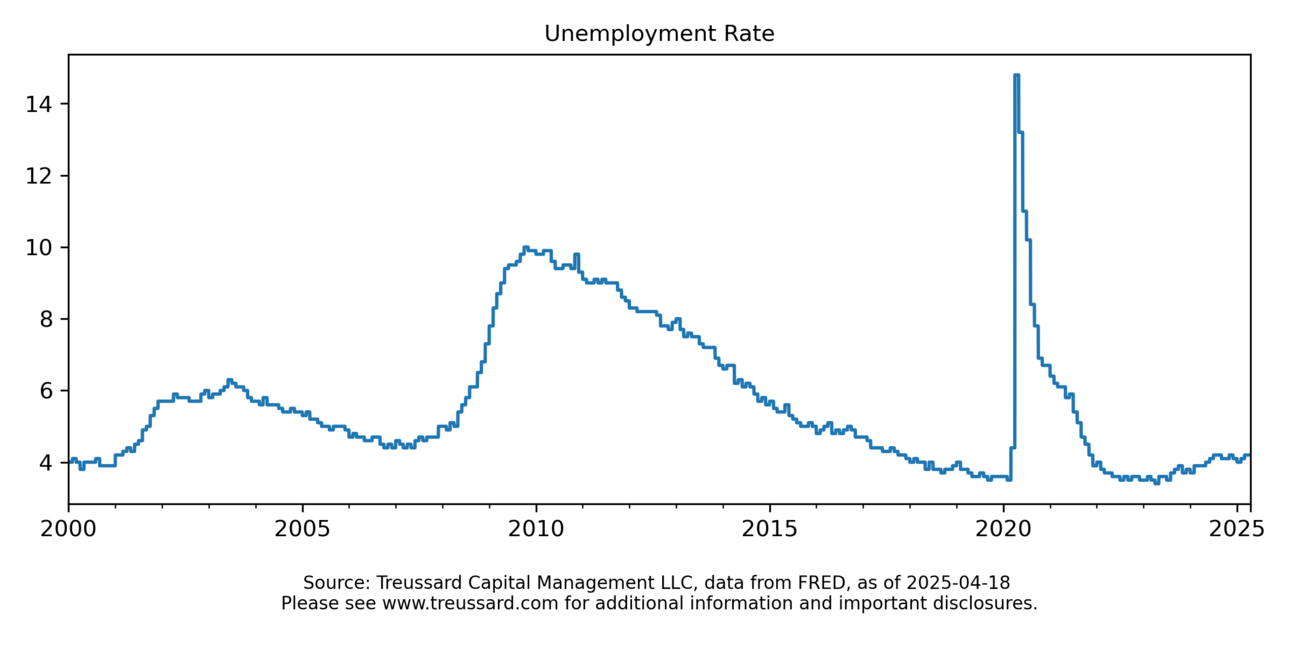

Unemployment came off its lows last year but then it settled at a very manageable sub-4.5% level.

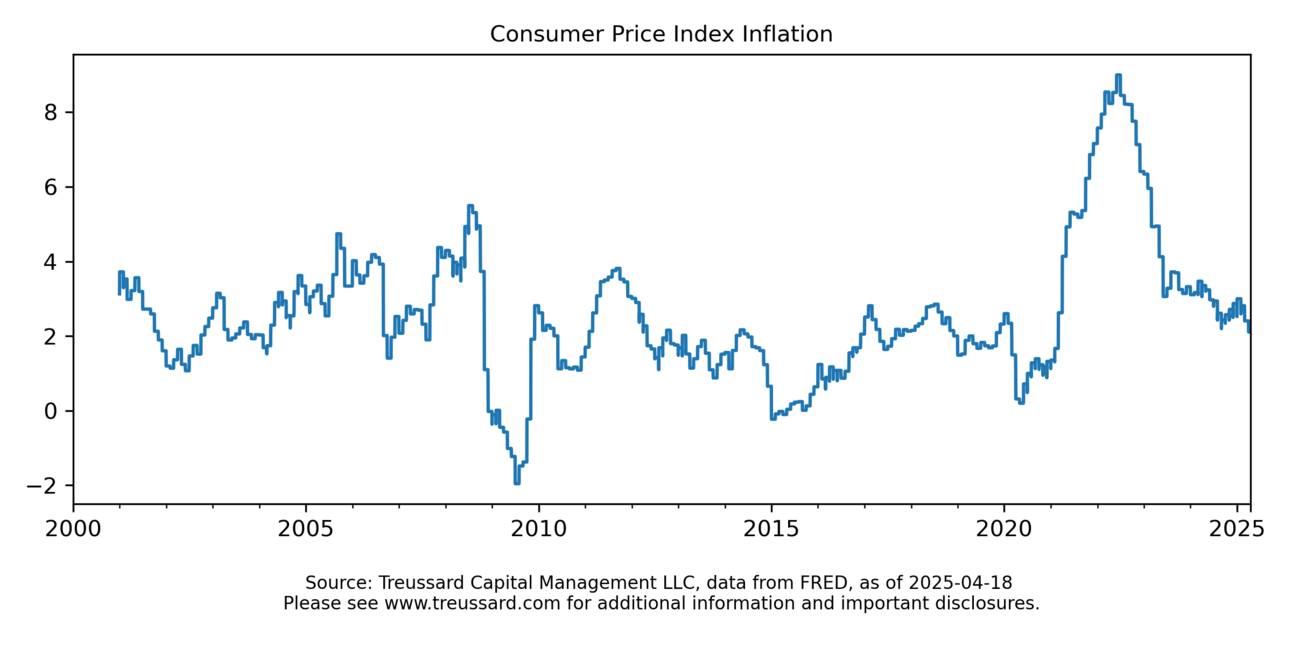

And consumer inflation came within spitting distance of 2% over the last year.

All of this underscores that the American economy entered 2025 in a truly "exceptional" shape.

One can also reasonably argue that Mr. Powell and his colleagues at the Fed pulled off the ultimate economic magic trick over the last couple of years: a "soft landing."

Well done to them, to the fullest extent that their actions led to this outcome.

The point is that there is a waterfall of concerns when it comes to fearing for the future of American Exceptionalism.

→ Most immediate is the concern that the U.S. economy will slow from here and that people will suffer the consequences of this self-inflicted slowdown, especially if it's paired up with a return of inflation.

People call that STAGFLATION, and it doesn't have a lot of fans.

→ Further down the line is a concern that something more fundamental could change in the way people treat U.S. assets, from our national currency to our national bonds.

We should not dismiss those concerns.

Strange things happen during times of war, including economic war.

And they happen fast…

But for now, let’s take comfort in the fact that we remain well within the range of recent history.

Let’s hope that continues to be the case.

Where Does That Leave You?

Look, I am committed to empowering you with knowledge.

That's kind of the point of this newsletter being called Wealth, Empowered. 🙂

It doesn't mean I know what happens next.

I don't think anyone does.

Yes, the headlines suggest tectonic shifts.

The numbers tell a more nuanced story — one that fits within historical ranges, at least so far.

This is a time for extreme thinking, not extreme actions.

Not yet, anyway.

Understanding your portfolio's exposures probably means more than making rushed decisions at this point.

But let's talk through an important what-if.

If rates push meaningfully past 5% toward 6%, we'll likely see significant stress in the financial system.

Highly leveraged institutions — from weaker banks to hedge funds — could face existential challenges under such conditions.

For investors that don't rely on leverage, losses would be painful but not "existential."

What the world would look like then is hard to predict, but opportunities would likely reveal themselves amid the wreckage.

Understand your risk exposures now, while markets are giving us time to think.

And be prepared to act if conditions deteriorate, all the while hoping that they don't.

Be well and don’t hesitate to reach out,

Jonathan 👋

📌 Whenever you are ready:

Follow me on LinkedIn for more insights: Jonathan Treussard, Ph.D.

Subscribe to my newsletter at www.treussard.com/subscribe

Just reach out, including here

SPECIAL DISCLAIMER: Registration as an investment adviser with the state of New York does not imply a certain level of skill or training. This registration is not an endorsement by the state or any regulatory authority. It simply indicates that the firm has met the regulatory requirements to provide investment advisory services.

Disclaimer: All content here, including but not limited to charts and other media, is for educational purposes only and does not constitute financial advice. Treussard Capital Management LLC is a registered investment adviser. All investments involve risk and loss of principal is possible.

Full disclaimers: https://www.treussard.com/disclosures-and-disclaimers.